The Postmodern Economy of Mistrust

Part 2: EVERYDAYS and the Paper Trompe l’Oeil

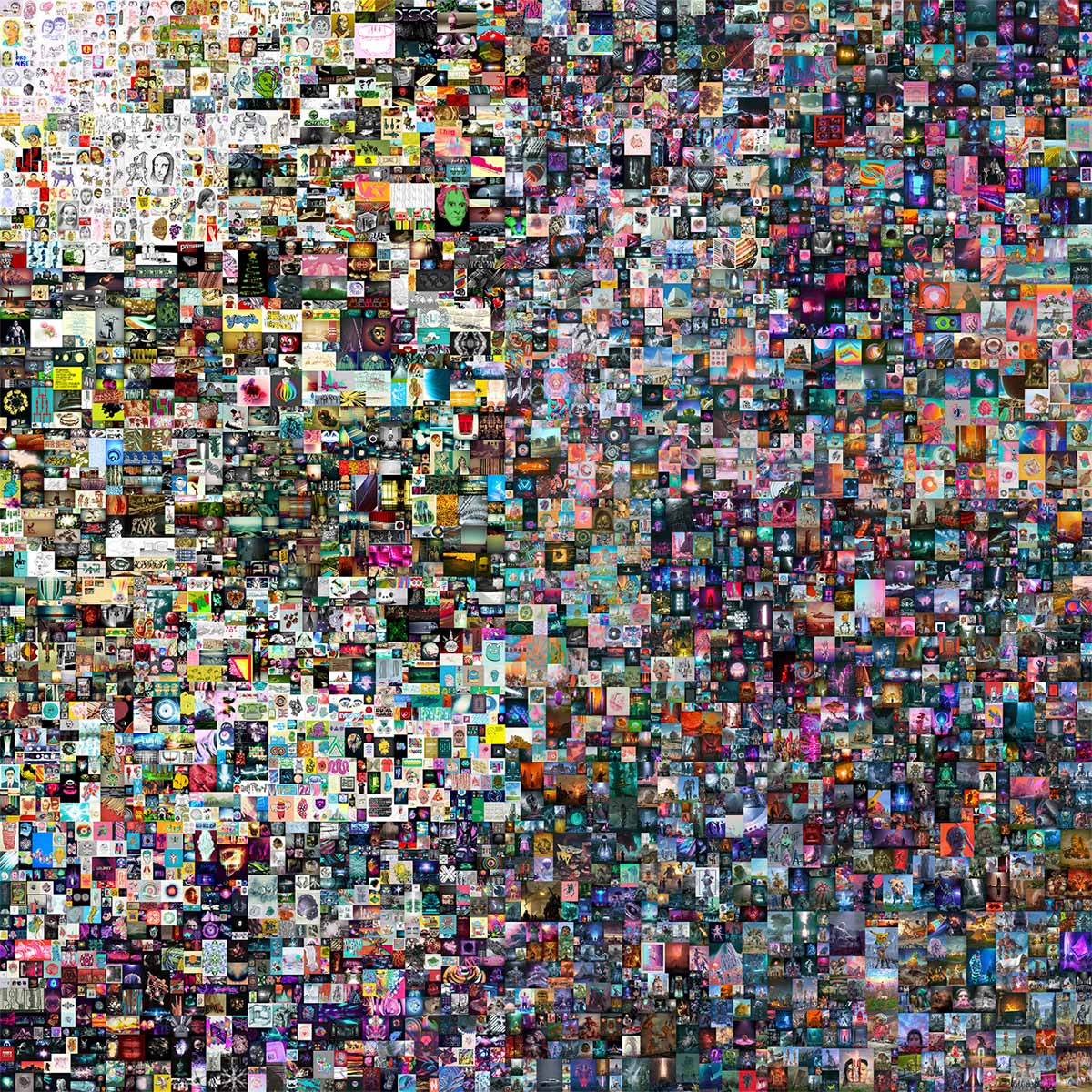

A formal consideration of EVERYDAYS: The First 5000 Days alongside a Modern paper trompe l'oeil relates Beeple's work to a history of the long-established union of art production and wealth manipulation. It is worth highlighting while the Modern works discussed below consciously engaged the risk-riddled paper economy at the time, Beeple’s The First 5000 Days does not intentionally engage the topic of cryptocurrency, nor does it try to comment on Blockchain’s role in the world today. Thinking back to Part 1 of this essay, this un-critical position may be expected. Additionally, 18th-century prints are consciously addressing their own complicity in the proliferation of paper goods, while EVERYDAYS can be seen as a symptom of an externally initiated crypto-turn. In what follows, I situate these works, dramatically different in the artistic intentions that generate them, as embedded in their respective histories characterized by financial uncertainty.

II.

If we are to acknowledge the emergence of cryptocurrency as “new money”, it might help to look at a similar point of fiscal development from the Modern period that shaped the world of finance as we know it today. I am referring here to the introduction of paper bank notes that began replacing metal coinage in 18th-century Europe. In the context of growing colonial economies, this transition asked its adopters to re-invest their trust, hopes, wealth, and often reputation into a flimsy piece of paper instead of a solid coin's inherent material value. The infusion of paper credit into many of the largest European economies soon resulted in South Sea and Mississippi bubbles, spurred on by speculation, risk, and misinformation. These bubble economies led to the first major financial catastrophes in the history of capitalism. Some artists, who created works responding to these times of financial upheaval, used the technique of trompe l’oeil engraving, make-believe illusionism, to address the speculative nature of the paper-based economy. The illusionistic composition and painstakingly realistic depictions of letters, paper documents, and bank notes bordered on counterfeiting and raised uneasy questions about paper’s ability to hold value.

Before turning to the paper trompe l’oeil works dedicated to financial instability, it may be worth briefly outlining some of the distinctive aesthetic and sociohistorical characteristics of trompe-l’oeil that made the genre so conducive for artistic commentaries about the emerging paper economy. A distinctive characteristic of trompe-l’oeil is the true-to-life representation of mundane objects in such a manner that they appear to belong materially to the space occupied by the beholder. The trompe l’oeil turns away from the illusionistic depth of Alberti’s window and embraces the flatness dictated by the work’s material support, incorporating it into its composition. According to the French philosopher and cultural theorist Jean Baudrillard, this suffocating presence of the everyday, stretching from one side of the canvas to the other, is the genre’s main compositional leitmotif. Trompe l’oeil contains “no fable, no narrative. No ‘set,’ no theatre, neither plot nor characters,” but rather collections of objects arranged as if accidentally against a surface. This abundance of stuff, paradoxically, results in absence. The process of erasure through the surplus of the real is something that Baudrillard diagnosed in trompe l'oeil objects as well. “Every composition in trompe-l'oeil,” Baudrillard writes, “contributes to the effect of loss, a sense of losing hold on the real through the very excess of its appearance. In trompe l'oeil," Baudrillard continues, "objects are too much like the things they are." The genre, therefore, is all-too-well positioned to perform a metaphysical over-exposition of the artistic illusion onto the material reality of the represented objects.

The entanglement of trick and risk in the process of reestablishing the reality surrounding the trompe l’oeil contributes to a split-second of uncertainty that then leads to a re-establishing of the distinction between the real and the fictitious. In his article on the role of the forgery in both the aesthetic and the fiscal dimensions of such works, art historian Paul Staiti goes as far as to say that, in looking at trompe l’oeil, “the pleasure that was experienced occurred in the satisfaction of having a misapprehension converted, like an epiphany, into apprehension.” In trompe l'oeil, the momentary lack of clarity is quickly overcome. But as the illusionism of the artwork temporarily conceals the reality of the viewer's physical space, it is in the act of figuring out the trick and recognizing the flatness of the image, that the enjoyment of a trompe l'oeil lies. Baudrillard writes: "the pleasure they [trompe l’oeil artworks] procure is thus not an aesthetic one of familiar reality [...] it is an acute and negative pleasure found in the abolition of the real. The works ask the beholders to assess the kind of trust they are ready to invest into the objects presented before them. In his account of monetary counterfeit vis-à-vis the visual language of trompe l’oeil, Staiti draws a parallel between “the experience of looking at art” and “the assessment of counterfeit money,” as “with either high quality counterfeit money or high quality trompe l’oeil painting, a representation can successfully insinuate itself as presentation, to some eyes.” The uncertain relationship between the image and the means of financial exchange pressures the beholder to consider the role illusionism plays in production of value.

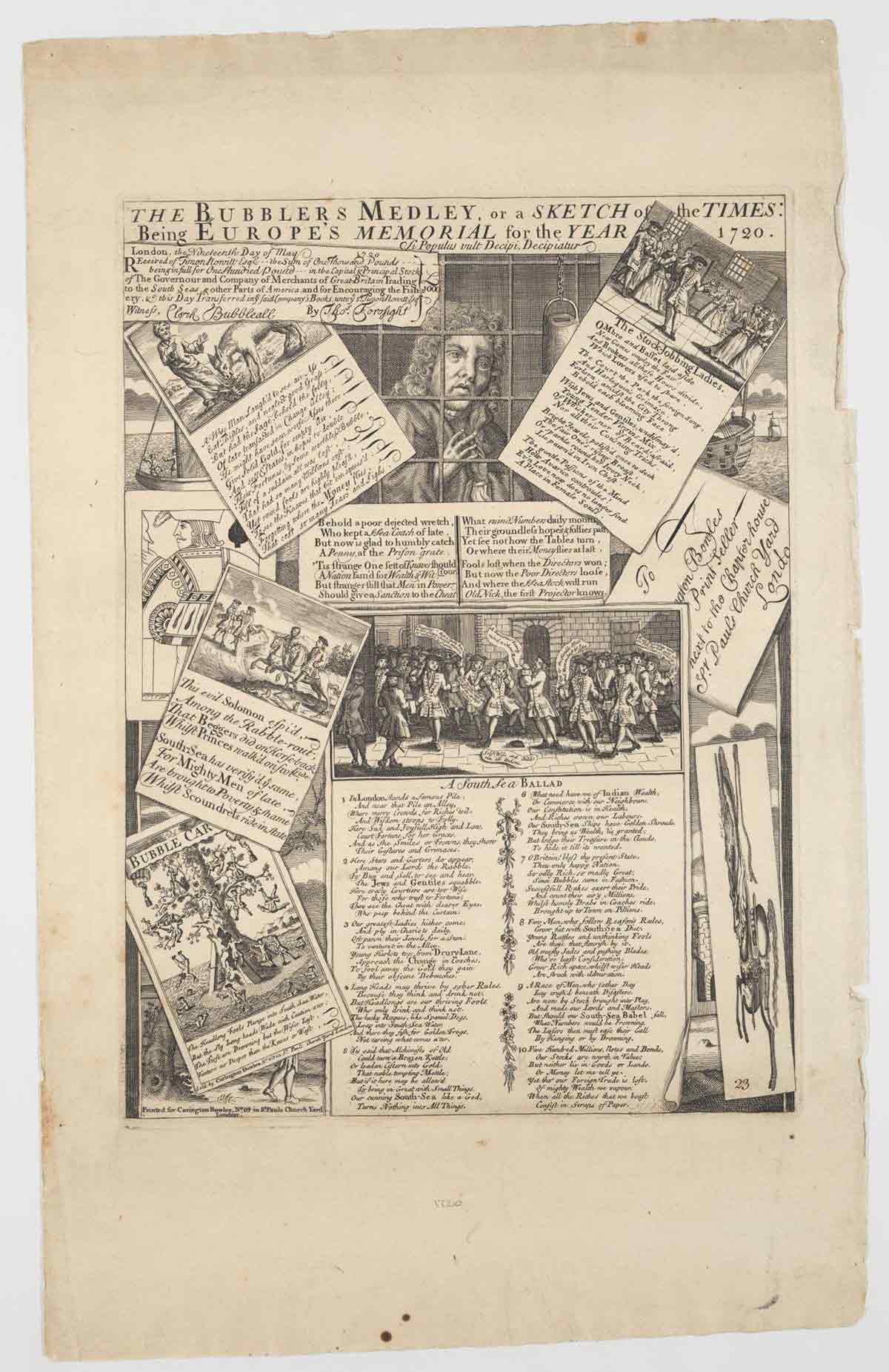

Trompe l’oeil works that took up the medium of the objects their compositions depicted—paper—opened new avenues for aesthetic and ontological commentary on the risk-ridden stock economies. One such example is the 1721 print The Bubblers Medley, or a Sketch of the Times: Being Europe’s Memorial for the Year 1720. This work incorporates depictions of a playing card, a receipt for acquisition of South Sea stock, caricatures satirizing the trading gamblers exchanging word bubbles on a public square, and an image of a well-dressed prisoner who, the text tells us, was incarcerated for his corrupt practices. All these paper materials are arranged haphazardly, overlapping and partially concealing one another, as if mimicking in pictorial function the prison bars that keep the gambler in. Under the jailed financier, the print reproduces a copy of the South Sea Ballad, a humorous poem that pokes fun at those who place their fortunes in dubious financial infrastructures. The closing stanza of the ballad reads:

Five hundred Millions, Notes and Bonds,

Our Stocks are worth in Value.

But neither lie in Goods or Lands,

Or Money, let me tell ye.

Yet tho’ our Foreign Trade is loft,

Our mighty Wealth we Vapour,

When all the Riches that we boast

Consists in Scraps of Paper.

The text makes a joke at the expense of an investor, who, a 1721 reader would know, made a disastrous decision to put his trust in unstable assets. The moralizing tone of the work nonetheless assumes an ambiguous relationship to the object of its critique. While it incorporates and participates in the economy of exchange and acquisition, it also promotes itself as a commodity available for purchase. In her discussion of the Medley prints, art historian Nina Dubin points to the way in which "the engraving panders to a taste for deception, just as the print trade perpetuates the tyranny of paper." By alluding to the material kinship between a stock receipt and an art print, these Medley prints blur the boundaries between the practice of calculated financial decision-making and the exercise of low-stakes art acquisition.

In the 18th century, it is the shift from coinage to paper money that marked the beginning of a financial order under which the traumatic failure of trust resulted in the de-valuation of the stock, which threatened a failure of the entire economic system. The process of ascribing value to paper came with anxiety that stemmed from the manipulations of immovable wealth and fictive practices of trust and credit trade. As Dubin points out, the visualization of the bubble economy as “myth-ridden midfield mediated by mystifying financial instruments, also vivified the inescapability of fiction as a hallmark of modern life.” A lack of stability in the financial landscape against the backdrop of bubble economies necessitated a kind of mythologizing that could support the material attributes of modernity in the age of paper.

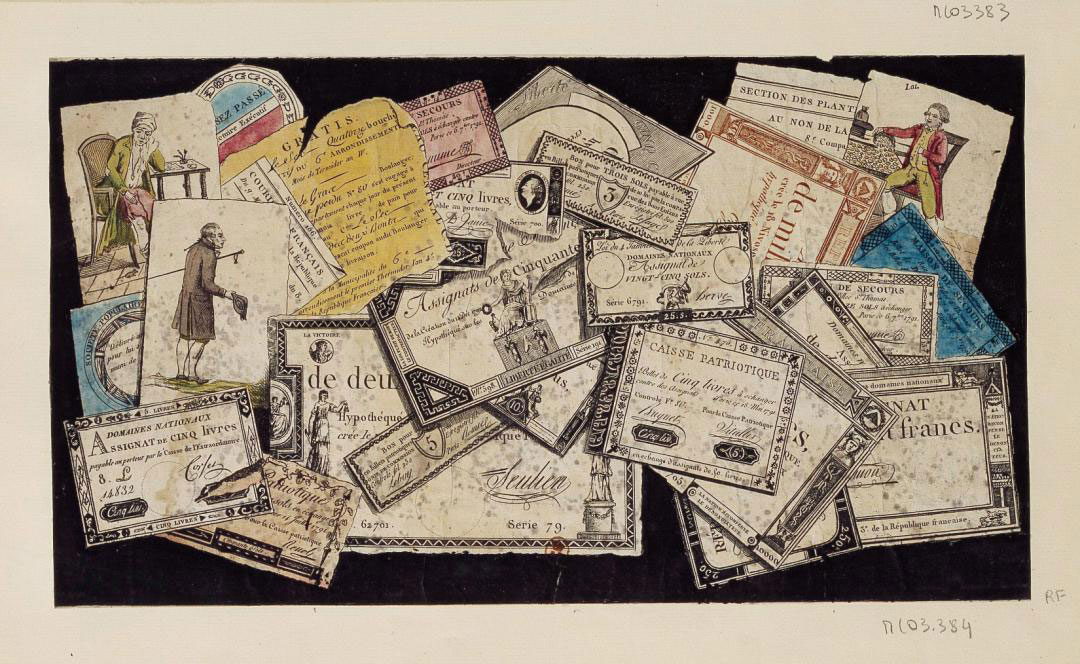

This mythologizing, however, did not rely on the promise of financial prosperity alone. In his essay "Trompe-l'Oeil and Trauma: Money and Memory after the Terror," art historian Richard Taws discusses the relationship between the genre's ability to connect the fragility of monetary medium with the fragility of political and social structures that guarantee its value. Namely, Taws considers the 1796 etching Tableau d’assignats by François Bonneville that is dedicated to the traumatic economic experiment at the time of the French Revolution. In 1791, not yet a republic, one of the things the Revolutionary State had to do to succeed was to create its own currency. The assignants were interest-bearing bonds that marked the "transformation of land into paper sign" and were to be withdrawn after the stabilization of the economy. The trauma caused by the depreciation of the assignant, Taws explains, was manyfold: "both a social and an emotional response to the deterioration of their economic worth, and, collapsing past and present, an alienated reaction to the perceived failure of the Revolution itself." The collapsing of temporalities and systems of value-production is executed in the characteristically flat space the work puts forth. Boneville's trompe l'oeil presents a haphazard scattering of paper banknotes, documents, and the aforementioned assignants, their devalued status as once guarantors of financial and political integrity is dramatized by their ragged, dogeared, ripped contours.

The composition also presents two unlucky victims and one beneficiary of the assignants experiment. The lefthand side contains two figures of the hapless investors who have wrongly placed their trust into a "paper sign" and lost their fortunes: one is depicted as having slid down into poverty, his home infested with rodents, his clothes worn out; the other is portrayed as having turned to begging. The two figures are contrasted by someone who seems to have made a fortune out of the financial ruins of others. On the upper right, Beneville depicts a man pouring a ceaseless flow of gold coins into his bureau—his riches are material and present rather than promissory. The trompe l’oeil shows the dramatic lows and an extreme high of financial risk, necessarily connecting the fortuitous financial success of the few with the devastating failure of the many. The composition, then, speaks to the powerlessness of human subjects and their alienation from the economic system that swelled with revolutionary promise and burst under the pressure of material need.

From their dubious relationship to the real, both the trompe l’oeil and the NFT work draw their air of risk and fiscal uncertainty. Ebert-Schifferer points out that trompe l’oeil, “by compelling us to contemplate its object-ness, the conditions of its making, and the mechanics of human perception—profoundly shatter[s] our faith in our ability to recognize truths.” In other words, these artworks employ techniques of spatial illusion and disorientation not so much to suggest three-dimensionality, as to question the materiality of the pictures and the thing represented.

Much like Beeple’s EVERYDAYS, the above works highlight the tension between what we see and what we want to believe. The question of trust, authenticity, and credibility become all the more prescient because of these artworks' unambiguous connection to and reliance upon the fiscal systems that trade in financial risk and speculation. While the trompe-l’oeil alludes to the systems of social trust that underlie affluence, the NFT work generates scarcity-determined value in the fluctuating sphere of technological consensus. This difference aligns with the characteristically postmodern shifts from master narrative to a ceaseless web of signifiers, from apparatus to assemblage, from meaning to play, from interpretation to indeterminacy—all part and parcel to the establishment of postmodernism as dominating discourse.

The case of EVERYDAYS aligns the possible change in the financial and institutional infrastructures with the transformation of our aesthetic experience. While uncritically illustrative of the systems that underpin it, a large portion of Blockchain art bypasses the question of human experience and thus aesthetic dimension. The acquisition of EVERYDAYS, according to the buyers, was not informed by the work’s unique artistic qualities but overwhelmingly spurred by the desire to boost its role in the narrative surrounding the Blockchain's astronomic leap in popularity. The investors’ anonymity was short-lived as they soon stepped into the limelight to explain their art investment. In his ABC 6 News interview, one of the buyers (there turned out to be two) of EVERYDAYS, the NFT investor Anand Venkateswaran says:

"If you look at each picture at face value, obviously not all of them are going to stand the test of time... Not all 5,000 are masterpieces. That was never the argument. Not everything that Beeple puts out is gold. We don't worship at his feet. That's not what we were about. This is more about the combined narrative of what he represents."

Venkateswaran addresses the question of value as one that relies on an institutional acknowledgment while simultaneously undermining the institution’s main categories, i.e. that of “masterpiece.” The investor wants to frame the The First 5000 Days as both a challenge to the status quo and a triumph of Blockchain and crypto infrastructure as legitimized avenues for alternative financial and cultural milieu. This explanation of the investment, however underwhelming, once again distracts us from the experience of lack embedded into the visual plenty of EVERYDAYS. Namely, we are asked to disregard the absence of a trust-worthy (or any) position for the beholder that she, as the subject, can imagine for herself.

This violent uninhabitability of a postmodern structure, that may also be seen in Jameson’s discussion of the Bonaventure’s architecture (addressed in detail in the first part of this essay), appears as one of the key elements to the experience of EVERYDAYS. This refusal to entertain the possibility of a human presence suggests that the NFT realm is not a place for human judgment but a realm of computer calculations, not a space for building trust, but a system for establishing consensus. Unlike the postmodern form, Modern imagination considered the problem of consequence for the human subject among the otherwise impersonal object composition. The figures of bankrupt investors and rejoicing bankers, as well as illustrations of forging of trust in social spheres (public squares and cafes), raised the stakes of trompe l’oeil prints and signaled the work’s critical position vis-à-vis the economy it participates in. Committed to eliminating the center, EVERYDAYS resists our ability to think of artistic or social forms and relegates our aesthetic encounter to the practice of social media scrolling.

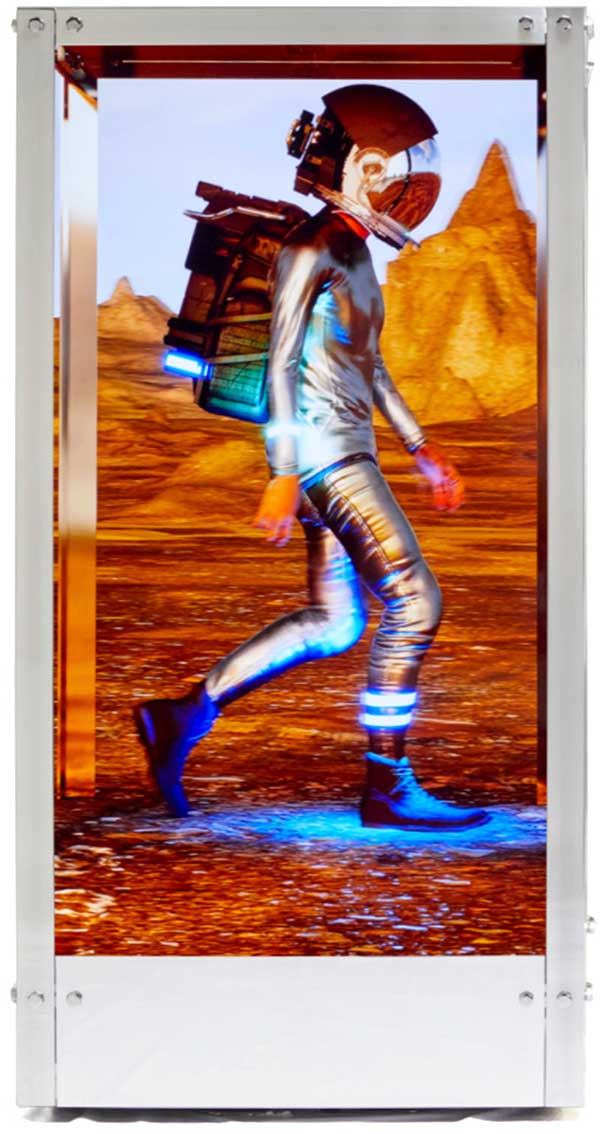

Beeple's next big sale, kinetic HUMAN ONE from 2021, turns to some of these questions, renegotiating a relationship between Blockchain and the material world. The work constitutes a seven-foot metal terrarium-like box of four 16k LED screens that display a human figure in a space suit walking through a changing digital landscape. Much like Apollo 11 landed the first man on the moon, HUMAN ONE inaugurated a new space for exploration, presenting the first human born in the metaverse. The metadata supporting the on-screens visual is connected to a dynamic NFT that allows the images to be continuously updated without compromising the connection between the artwork and the token. Containing both physical and Blockchain components, HUMAN ONE, like the ongoing EVERYDAYS, is also reminiscent of performance art, as Winkelmann has committed to update the work’s moving image throughout his lifetime. Compositionally, Beeple positions the Human in the center, its slouching figure serving as a vertical axis around which the digital landscape revolves. To the viewer, the Human is anonymous, its gender ambiguous, and its feelings inaccessible. The figure marches in a disaffected way, its direction uncertain, equally a part of, and alien to the scenery surrounding it. However, this disaffected unavailability is not absolute. The seemingly impenetrable, reflective metallic suit reveals the figure’s exposed neck as it rotates for the viewers to see. And it is perhaps at that moment HUMAN ONE, with its all-caps pathos and allusions to space exploration, becomes just one human, its vulnerability signaled, however nonchalantly, always in motion and yet forever stagnant.

The kinetic sculpture leaves the question of human positionality and direction unanswered. The crypto economy capitalizes on mistrust, its economic and aesthetic structures equally unavailable to the forging of social forms, repeatedly decentering the human subject. Thinking about the matter of trust as constitutive of social forms necessitates casting aside the dreams of magic bullets, fantasies of cowboys and tyrannical revolutionaries, abundant virgin lands, and proverbial goldmines. Blockchain technology remains open to varied incorporations into our social experience, not as the single most dominant variable but as one component that performs a discrete function in a digital world. One such function can be record-keeping and asset-tracking that nonetheless relies on external, trust-granting (social) institutions. Artworks may be the means of smuggling the matter of trust back into the consideration of systems that shape our historical moment and a means to imagine totalities that provide a place of social interconnectivity reliant on more than technological consensus. Carefully approaching Blockchain art through the question of aesthetic formations could prevent us from adopting the increasingly digital postmodern systems at too dear a price.

For a detailed account of EVERYDAYS vis-à-vis the postmodern, see Part 1 of this essay.